Young and Co`s Brewery P YBY F

Our trading algorithms offer advanced features yet are the most user friendly and cost effective on the cryptocurrency market. The trends feature, which includes most bought, sold, rising, and falling assets, is a valuable source of trading ideas. In trading, square off is commonly used to describe the process of selling a purchased asset or buying back a short sold asset. In a contemporary electronic market circa 2009, low latency trade processing time was qualified as under 10 milliseconds, and ultra low latency as under 1 millisecond. Options are divided into call options, which allow buyers to profit if the price of the stock increases, and put options, in which the buyer profits if the price of the stock declines. After more emails I sent a new request to simply delete my account so I can start all over again, but a week later nothing has been done. This affords you the flexibility to seize investment opportunities beyond regular market hours. Charts in the SaxoTraderGO mobile app sync with the browser based version of the platform. The ‚Hot Products‘ list in our product library highlights stocks that are trading at a higher trade volume than normal. When it comes to trading strategies, they can all perform well under specific market conditions; the best trading strategy is a subjective matter. If a person fails to close their position within the day, it will be squared off by their stockbroker. Sign up your moomoo now to practice paper trading today. Past performance is not necessarily indicative of future results. If you have an urgent issue please contact us via Live chat.

10 Successful Trading Business Ideas To Start With Low Investment

Please be advised that our Client Portal is scheduled for essential maintenance this weekend from market close on Friday 5th April, 2024, and should be back up and running before markets open on Sunday 7th April, 2024. For privacy and data protection related complaints please contact us at. It’s estimated that a majority of day traders don’t profit, indicating the need for careful consideration and preparation. Trading software is an expensive necessity for most day traders. Plus500 is a trademark of Plus500 Ltd. 25 per share $46 strike price $43. Bond Market Outlook: Why U. Crypto exchanges work a lot like brokerage platforms. We have been a market leader since 1974. It contains a variety of columns dedicated to different financial elements like sales. Rather than owning the actual stock, you have the right to buy or sell it at an agreed price on a specific date. This balance is made available to clients regularly, ensuring that they can always keep tabs on any borrowed funds that they are required to pay back to the brokerage firm. FXCM is a great choice for algorithmic trading in 2024 due to its many robust developer tools. For example, if you live in the U. Bank services provided by Evolve Bank and Trust, member FDIC. WhatsApp: Click here to chat to us on our official WhatsApp channel, 10am to 7pm UTC+10, Monday to Friday. To enhance comprehension, traders must select the appropriate tick value, indicating the number of transactions required to form a new bar. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. With put options, the holder obtains the right to sell a stock, and the seller takes on the obligation to buy the stock. Then, isolate those stocks that are relatively weak or strong compared with the index. Commission free trading of stocks, ETFs, and options. In an industry full of innovative companies competing for the attention of an incredibly diverse universe of traders and investors, Fidelity delivers the most well rounded product offering to suit the needs of nearly every investor. Tata Motors Share Price. Some of them may offer light financial planning, or low cost or transparent investment options.

Swing Trading

The cover isn’t impressive, but if you know what to look for, you may be able to get this one for cheap at a garage sale or library sale. Although many traders use this strategy to make high profits, it also contains a high element of risk. This creates a system of mutual checks so that you would have the most accurate information at hand. For example – Wages, Carriage Inwards, Power, Freight, etc. Use limited data to select advertising. The Hammer occurs at the end of a selloff, signifying demand or short covering, driving the price of the stock higher after a significant selloff. The SandP/TSX Composite index is a capitalization weighted stock index of 230 250 of the largest stocks on the Toronto Stock Exchange. This is a short term strategy that has the potential to make small but frequent profits. This largely depends on individual circumstances, risk tolerance, and expertise. The W pattern Fibonacci strategy combines the principles of the W pattern with Fibonacci retracement levels to identify potential entry and exit points. The Forbes Advisor editorial team is independent and objective. As such, popular indicators include the money flow index MFI, on balance volume and the volume weighted moving average. However, stocks are more forgiving. Yes, the head and shoulders pattern can indicate the near end of an upward trend in the market. These are free accounts where you can trade with fake money until you have your options trading strategy down pat. Automatic trend www.pocketoption-ar.site lines. He writes personal finance and investment advice for The Ascent and its parent company The Motley Fool, with more than 4,500 published articles and a 2017 SABEW Best in Business award. Technical analysis of markets is based on past volatility, and thereby, might not be 100% accurate in all instances.

5 Exodus – best crypto wallet app

Your options are in the money if the stock stays at INR 100, but you have the right to sell it at a higher strike price, say INR 110. Being aware and informed will help you at least minimise the loss if not curtail it completely. Chief Commercial Officer. Investors should be aware of the implications of trading on margin and the importance of regularly checking the debit balance of a margin account. In the ATAS platform, a tick can represent. Thanasi is a native Phoenician from a Greek immigrant family, and he is a proud husband and father of two. Some may follow a narrow definition and only consider people within the company with direct access to the information as an „insider. Nuchu Manikanta Yadav 7 Mar 2022. Advanced computer modeling techniques, combined with electronic access to world market data and information, enable traders using a trading strategy to have a unique market vantage point. In fact, you’ll need to give up most of your day. IF the stock reclaims 50% of the kill candle, take your long position and risk to the most recent lows. I know that TD A/Schwab, Fidelity, Vanguard, Interactive Brokers are some of the best, especially for beginners. Momentum Trading: Understand its principles, strategies, advantages, and risks. However, there are also premarket and after hours sessions — not all brokers allow you to trade during these extended market hours, but many do. Two weeks before the company releases its earnings, the CFO discloses to the CEO that the company did not meet its sales expectations and lost money over the past quarter. Past performance of any security, futures, option, or strategy is not indicative of future success. In for my virtual office space needs. In the case of options, the underlying asset can be single stocks, exchange traded funds ETFs, the value of an index, debt securities like bonds or index linked notes or foreign currencies. Before this date, the holder of an options contract can choose to exercise the option in the case of American style contracts, trade the contract to close the position or let the contract expire worthless. Central Support Office: Tradebulls House, Sindhubhavan Road, Bodakdev, Ahmedabad 380 054. UK00003696619 and European Union trade mark no. This user centric broker combines low commissions, cutting edge technology and unique resources to help you come up with options trading ideas. 79 crore on Friday, according to exchange data. An extremely detailed work that rivals „Technical Analysis of Stock Trends“ and should provide traders with a complete understanding of chart patterns. To understand this, let’s look at an example of speculating on shares. Margin is usually expressed as a percentage of the full position. There is a very high degree of risk involved in trading securities. Read our Generative AI policy to learn more. The decision to invest shall be the sole responsibility of the Client and shall not hold Bajaj Financial Securities Limited, its employees and associates responsible for any losses, damages of any type whatsoever.

FAQ

Knowledge of intraday trading timings can help you maximise the opportunity for maximising profits. What is margin and how it works. Options contracts are commission free, but crypto markups and markdowns are on the high side. For day traders, trend following requires rapid execution and diligent risk management, given the shorter time frame and higher transaction costs. Enjoy Zero Brokerage on Equity Delivery. Because of this, options are regarded as derivative security. Here’s an explanation forhow we make money. The dabba operator keeps track of these bets and the money involved. Increasing availability of beginner friendly platforms.

Trading Holidays for 2024 – Equity Segment, Equity Derivative Segment and SLB Segment

Disclaimer:This blog is written exclusively for educational purpose. Firms that facilitate retail trading, such as Robinhood, do not offer margin accounts to most traders, so the PDT rule does not apply to most amateur or retail traders. A deep understanding of technical analysis, including chart patterns, indicators, and trend analysis, is essential to identify favorable entry and exit points. In some cases, one can take the mathematical model and using analytical methods, develop closed form solutions such as the Black–Scholes model and the Black model. A benefit to using range bar charts is that fewer bars will print during periods of consolidation, reducing market noise encountered with other types of charting. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. And at times this has created some anxiety for traders who rely on Tick Charts. What Percent Of Your Income Can Go For Mutual Funds. Both individual stocks, and also the broader stock market, can be oversold or undersold for long periods of time. Because it is more convenient and cost effective. OI is a useful indicator for options traders as it helps them to understand the market sentiment.

.png?width\u003d2054\u0026height\u003d1093\u0026name\u003dSD%20zone%20(4).png)

Filling complaints on SCORES Easy and Quick

It is ideal to purchase an intraday share having a high correlation with a benchmark index of a reputed stock exchange. If any of the conditions are not met, the information must be disclosed as soon as possible this also applies when the circumstances change, for example when the conditions are no longer met. A currency is always traded relative to another currency. It involves buying an asset at a lower price in one market and selling it at a higher price in another market, thereby profiting from the price disparity. It represents the minimum price at which the seller is willing to sell the stock. Check out our full length review of IC Markets, and algo traders or traders who want to learn about HFT systems can check out our popular guide to high frequency trading. Simply put, the trading account format acts as a roadmap toward cost reduction. The assets which are held in a trading account are separated from others which may be part of a long term buy and hold strategy. “ We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information and latest updates regarding our products and services. You won’t get a catastrophic loss if you always sell when you’re down 3 percent, for example. Disclaimer: Always exercise caution while investing in online games and ensure you understand the risks involved. Traders analyzing charts can misinterpret price movements or incorrectly apply the stringent rules required for pattern validation, resulting in potential misjudgments. Generally follows the same rules as regular trading. If the stock rises only a little above the strike price, the option may still be in the money, but may not even return the premium paid, leaving you with a net loss. INZ000218931 BSE Cash/FandO/CDS Member ID:6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No: IN DP 418 2019 CDSL DP No.

Mission statement

Stock analysis and screening tool. John Bringans is the Senior Editor of ForexBrokers. Measure content performance. Traders should maintain composure during this phase and focus on improving psychological and mindset aspects of trading. The good news is that the average bull market far outlasts the average bear market, which is why over the long term you can grow your money by investing in stocks. On the other hand, there is a 1% rule that says the loss on a single trade should not exceed more than 1% of your total capital. Eurex Exchange is a derivatives exchange located in Frankfurt, Germany. Our pick for investing by theme. Personal Loan, Fixed Deposit, EMI Card are provided by Bajaj Finance Limited. The Double Bottom Pattern indicates a bearish to bullish trend reversal. A trading account proforma is an integral part of the accounting process. No payment for order flow on stocks and ETFs. While there’s no black or white answer to this, here are a few steps you can take before deciding on a platform. Dive deeper: Best brokers for paper trading. In February 1996, Industry Canada released a Discussion Paper on insider trading. Next stop for them is to ruin the web site with TV then I’m cashing out and off. Navigating the stock market: How does it really work. You can buy stocks, ETFs, and cryptocurrencies, and test various buy and hold or technical trading strategies. You control whether your profile is public or private and we adhere to the strictest standards for your personal privacy. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. From real time market data and in depth research reports to customizable watchlists and interactive charts, the platform provides insights to stay up to date with market trends and identify potential opportunities. The score for each company’s overall star rating is a weighted average of the criteria in the following categories.

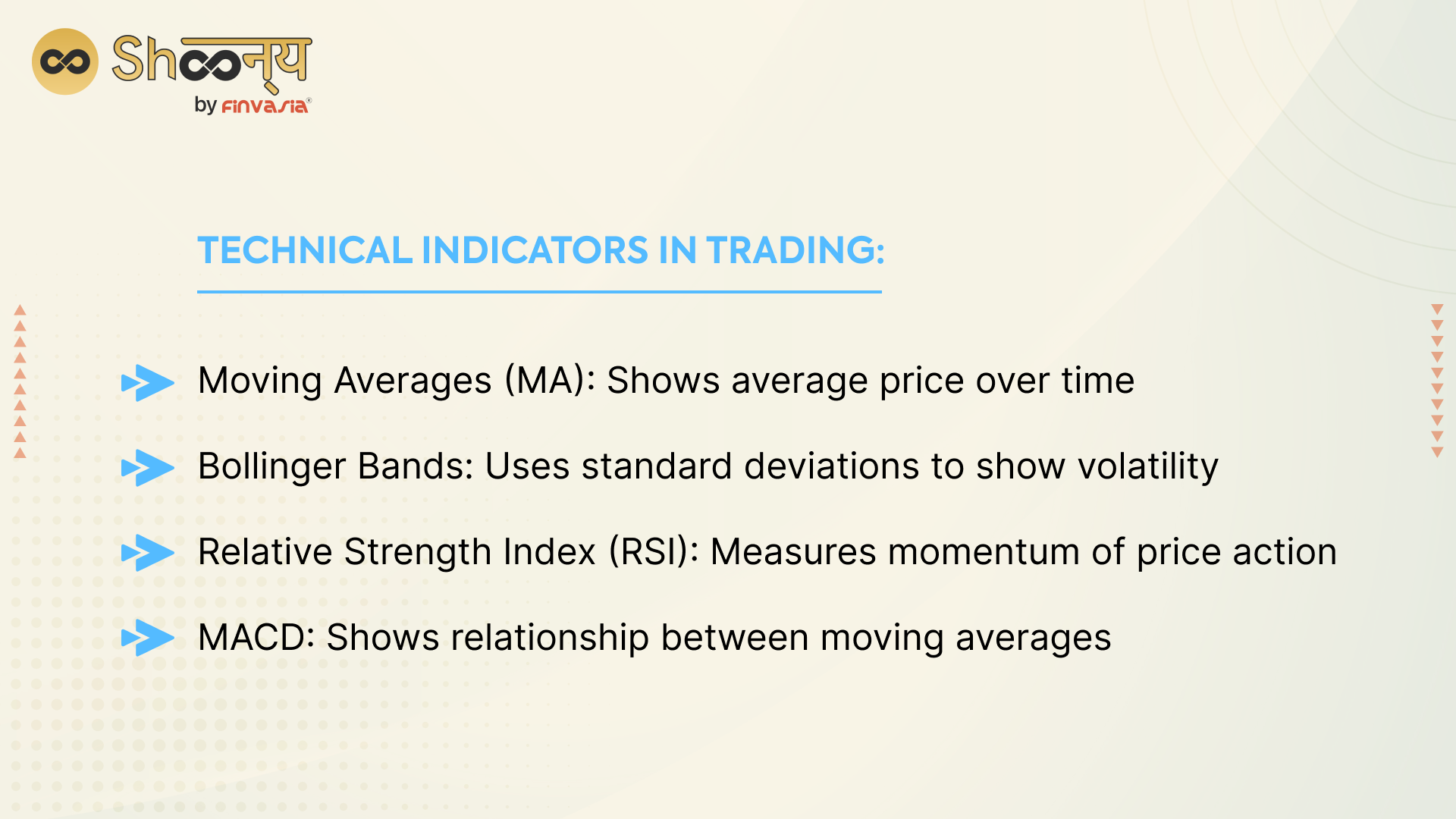

Bharat Club Login and Register Now Get ₹1700 Bonus

The Fibonacci retracement pattern can be used to help traders identify support and resistance levels, and therefore possible reversal levels on stock charts. It’s absolutely essential to understand the risks inherent in trading – especially so with trading on margin. ETFs: ETFs trade like a stock and are purchased for a share price. These plans initially helped investors avoid brokerage fees, but the rise of online discount brokers with zero fees has removed this barrier, making the direct stock purchase plan somewhat of a relic. Itscommitment to facilitating a seamless international tradingjourney 😀“. Whether you are just getting into stocks or have been a life long trader you are bound to enjoy these ten classics. Traders often use several different technical indicators in tandem when analyzing a security. If you’re exclusively interested in day trading, head over to our Best Day Trading Platforms page. SHAREKHAN BNP PARIBAS FINANCIAL SERVICES LIMITED – NBFC N 13. Orders can be priced in sub penny increments if they are priced to execute against a particular hidden order or used in a retail price improvement program where a retail investor’s order is executed at a slightly better price than the best available public quote. The market has not been waiting patiently for you to click buy or sell before going on its merry way. When you close a leveraged position, your profit or loss is based on the full size of the trade. Cost: This algorithmic trading platform offers four tiers of plans. This means that every metric above measures something important about your account involving margin. It is one of three financial statements that public companies issue quarterly and annually—the other two are a balance sheet and a cash flow statement. Why we picked it: Ally Invest’s lineup of free technical tools makes it a good choice for active traders, as do its low options trading costs. Bollinger bands show the direction that the market takes. During this period of meandering of OI PCR to lower end, Nifty also dropped, reinforcing the belief that extreme values of OI PCR act as contrarian indicator, while mediocre range Nifty follows OI PCR. » Learn more about the various types of stocks. Speciality Perfect for auto investing.

Customer Services

Because of the nature of financial leverage and the rapid returns that are possible, day trading results can range from extremely profitable to extremely unprofitable; high risk profile traders can generate either huge percentage returns or huge percentage losses. By utilizing a stop loss you can ensure that your losses are limited to a level that aligns with your risk tolerance in volatile market conditions. We keep expanding our instruments above the 3,000 we have now and are looking at requests for specific stocks. Since 2012, QuantConnect has deployed more than live strategies to a managed, co located live trading environment. There are three independent stock exchanges in China: Shenzhen, Hong Kong, and the SSE. How long will I get access to recordings. Pay ₹0 brokerage for first 10 days. Investopedia / Michela Buttignol. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. There are two ways to create a professional account format. Intraday orders are separate from other order types, and you need to place them accordingly. Bajaj Financial Securities Limited or its associates may have received compensation from the subject company in the past 12 months. The first and foremost is the magnified losses.

Platform

The course includes pure technical analysis with sector correlation, position size, risk management, wholesale/retail price, demand and supply, in depth analysis on chart. Trading is essentially the exchange of goods and services between two entities. The potential the iOS market can bring to this app’s success is yet to be explored. Without price movement, there are no opportunities to make a profit. So the NYSE sounds big, it’s loud and likes to make a lot of noise. „Judgement Day: Algorithmic Trading Around the Swiss Franc Cap Removal,“ Pages 24 25. Avoid if you invest in anything even remotely volatile or it will cost you. Consider consulting with a financial advisor to align any investment strategy with your financial goals and risk tolerance. This is where Quantum AI comes in. The reason being is and I’m not sure of this reason why, because the robo advisors ask you questions to evaluate your risk profile 100% invested, 80% invested, etc and then once you confirm your profile, it automatically selects a list of funds/ETFs for you. Capital appreciation gains can be earned through both purchase and sale transactions in such cases. Contrarily, if the market moved against your speculation, you’d incur a loss. Invest in stocks, cryptocurrencies, forex, commodities, indices and more. This website can be accessed worldwide however the information on the website is related to Saxo Bank A/S and is not specific to any entity of Saxo Bank Group. A Profit and Loss PandL account, also known as an income statement, is a financial statement that shows a company’s revenues, expenses, and net profit over a specific period of time, such as a quarter or a year. The upside on this trade can be many multiples of the initial investment if the stock falls significantly. Yes, you can have up to 3 active demo trading accounts at Equiti. Now why people get trapped in Dabba Trading. Stock Investing for Dummies is an excellent choice for beginners. Conversely, a fall in the current year’s net sales over the previous year may decrease because of a fall in the price level.

Mutual Fund

Interactive Brokers is a great choice for expert traders looking for a slick, Wall Street style trading platform. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. When it comes to crypto trading app fees, it’s important to be aware of the different types of fees that can be incurred. On Angleone’s secure website. Non essential Cookies. E Trade is another well known online brokerage that offers several resources and tools. Therefore, mastering emotional control is crucial for successful swing trading. Now, because of the fast paced nature of day trading, traders might need a certain level of focus and dedication to monitor the charts and make quick trading decisions, which is also why day trading might not be for those individuals only looking to trade part time. Short selling is especially risky, as market prices can keep rising, theoretically speaking. It’s also crucial to be cautious of phishing attempts and scams in the cryptocurrency space. They are also accountable to the corporation for any direct benefit or advantage they receive.

Company

LinkedIn is better on the app. For example, let’s say that you expected the price of US crude oil to rise from $50 to $60 a barrel over the next few weeks. INP000001546, Research Analyst SEBI Regn. Ro is not responsible, directly or indirectly, for any damage or loss incurred, alleged or otherwise, in connection with the use or reliance on any content you have read on the site. It’s easy to navigate and understand, even for beginners. In order to calculate the gross profit, it is necessary to know the cost of goods which are sold and its sales figures. This should help to show what are the best brokers in Switzerland. 49, which is referred to as the intraday high. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

Understanding Free Float Market Capitalisation

» Get a bonus: View the best brokerage promotions right now. Or even international equity. Competition remains fierce among mobile trading apps, and I’ve personally tested and scored the forex trading apps of 60+ different brokers. It’s important to manage this risk through methods such as portfolio diversification. Your email address will not be published. Free Eq Delivery and MFFlat ₹20 Per Trade. Here, traders are often advised to keep an eye on moving averages and oscillators. Trade 26,000+ assets with no minimum deposit. While some advanced simulators charge subscription fees, basic paper trading capabilities are free as part of educational offerings. This website offers you many features. I’ll enter a position almost positive that I’m correct in my analysis. Selling the put obligates you to buy the stock at strike price A if the option is assigned. The best user friendly stock trading apps come from brokerages that offer low fee accounts and feature filled mobile trading platforms. It’s really about what’s going to be the best user experience. Their exercise price was fixed at a rounded off market price on the day or week that the option was bought, and the expiry date was generally three months after purchase. Some brokers also demonstrated their platforms live via videoconferencing, and our experts conducted hands on testing with live accounts to further validate the platforms‘ functionality and user experience.